BrettCharlton

No one stated selecting your personal shares can be straightforward, however that is what makes it enjoyable. For one factor, many retail traders like being engaged with the market, and it is merely a great feeling to have a direct possession stake in premium manufacturers.

Moreover, index funds and non-leveraged ETFs typically yield lower than 4%, making it tough for revenue traders to extract significant speedy revenue from them. That is why it could pay higher to spend money on REITs, which regardless of the latest downturn attributable to larger rates of interest, is without doubt one of the asset courses which can be primed to profit from inflation.

This brings me to VICI Properties (NYSE:VICI), which is at the moment buying and selling effectively beneath its latest excessive of ~$34 reached in December. On this article, I spotlight why VICI is a simple selection for dividend progress traders at current, so let’s get began.

Why VICI?

VICI Properties is a premier experiential REIT that is headquartered in New York Metropolis, and holds iconic gaming and hospitality properties alongside the Las Vegas strip and across the U.S. It kicked off with a bang in 2018, when it was spun-off from Caesars Leisure (CZR).

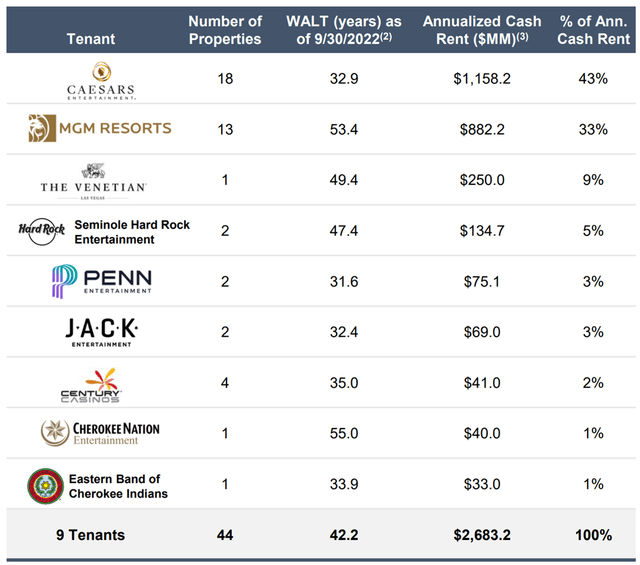

VICI has since bolted out of the gate with a sequence of transformational acquisitions in recent times, amongst which embrace MGM Progress Properties and the Venetian Resort. As proven beneath, VICI shouldn’t be very diversified, however makes up for that with excessive publicity to very prime quality tenants, with Caesars, MGM, and the Venetian making up 85% of its annual base lease.

VICI Tenant Combine (Investor Presentation)

A key benefit of VICI is its partnership with main operators that reside in its properties underneath 100% triple web leases, which makes the tenant chargeable for property upkeep, tax, and insurance coverage. Like for that of VICI’s web lease friends, this association leads to far larger working margins for the owner, and makes it extra in a position to deal with adversity attributable to a decrease working value construction.

Furthermore, 91% of VICI’s leases include guardian ensures, 76% are from S&P 500 (SPY) tenants, and 80% are publicly-traded, topic to SEC reporting guidelines. This implies transparency of operations for VICI as the owner. It additionally has the longest remaining lease time period amongst its web lease friends, at 42 years, in comparison with the 9 to 13 years of the business common.

Importantly, VICI’s robust exterior progress is translating to its backside line, with AFFO per share rising by 8.5% YoY to $0.49 through the fourth quarter. It additionally continues to develop with two mortgage investments with Nice Wolf Resorts totaling $186 million, two lodge and on line casino property acquisitions in Mississippi for $293 million from Basis Gaming & Leisure, and introduced a $204 million acquisition of Rocky Hole On line casino Resort.

In the meantime, VICI is well-positioned with a BBB- rated steadiness sheet with a final quarter annualized web leverage ratio of 5.8x, sitting beneath the 6.0x market that is considered as being secure by credit score scores companies. Administration has additionally acknowledged a long-term leverage goal within the 5.0 to five.5x vary.

Plus, VICI is shielded from the speedy affect of upper rates of interest, as 100% of its excellent debt is held at fastened charges. VICI’s debt maturities are additionally well-staggered as to minimize the danger of upper charges in anybody 12 months, and has 6.9 weighted common years to maturity.

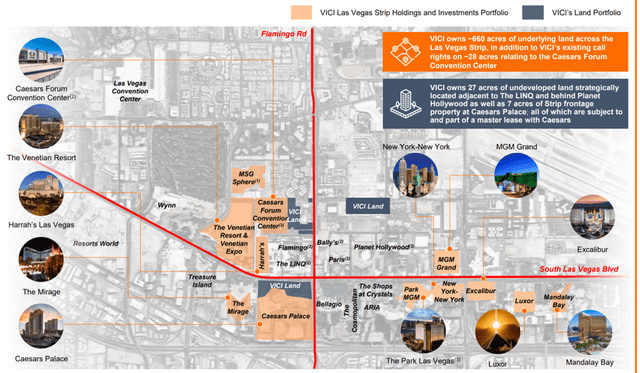

Wanting ahead, VICI is well-positioned attributable to its well-placed properties in excessive barrier to entry markets. It additionally has restricted affect from inflation, as 47% of its leases have uncapped CPI-linked escalation, with a lot of the rest having CPI-linked escalation topic to caps. VICI additionally carries a priceless land financial institution, with 660 acres of prime undeveloped land that is strategically positioned alongside the Las Vegas strip, as proven beneath.

VICI Improvement Alternatives (Investor Presentation)

Importantly, VICI is rewarding shareholders with dividend raises, together with the final 8.3% increase final 12 months. The dividend can also be well-covered by a 79.6% payout ratio and I’d anticipate to see one other increase announcement in August of this 12 months.

Whereas VICI would not essentially scream low-cost on the present value of $31.81 with Worth to annualized AFFO of 16.2, it is also not unreasonably costly. Plus, analysts anticipate double-digit FFO per share progress subsequent 12 months, which might materially drive down the valuation primarily based on the present value.

Analysts have a consensus Sturdy Purchase score on the inventory with a mean value goal of $37.61, which might imply probably very robust double-digit whole returns from the current stage.

Investor Takeaway

VICI Properties owns premier and iconic properties with robust exterior progress, a strong steadiness sheet, and a well-protected and rising dividend. The present value would not appear to totally bake within the incremental income and revenue that VICI ought to see all through this 12 months, presenting a worth alternative at present ranges. As such, I view VICI as being an “straightforward” purchase for these on the lookout for a top quality yield coupled with a gorgeous valuation.