Constantinis/E+ by way of Getty Pictures

Funding Thesis

Masonite Worldwide Company (NYSE:DOOR) is a cyclical firm. Whereas it delivered a 30 % ROE for FYE Jan 2023, its long-term efficiency and worth must be considered by way of a cyclical lens.

There’s a sturdy correlation between DOOR income and the US Housing Begins. As such I’d peg DOOR’s cyclical efficiency to that of Housing Begins. Whereas the present efficiency is nice, it doesn’t mirror the poorer long-term cyclical efficiency.

Primarily based on the cyclical lens, there isn’t a margin of security on the present market value. The market is pricing DOOR as if it could proceed to develop income and enhance its margins.

Thrust of my Evaluation

I’m a long-term worth investor. After I analyze and worth corporations like DOOR, I attempt to see the place they are going to be in 5 to eight years’ time.

To get an image of the mid-to-long time period future, I begin by wanting on the performances over the previous decade. On this context, I like cyclical corporations as a result of the historic performances are good indicators of the longer term as a consequence of their cyclical nature.

DOOR is a number one designer, producer, and distributor of doorways for the residential and non-residential markets. For the FYE Jan 2023, the North American residential market account for about 79 % of its income.

I’ll present that there’s a sturdy correlation between its income and the US Housing Begins. The US Housing Begins is cyclical.

I can even present that its Gross Revenue margins are correlated to income. On the similar time, SGA margins are comparatively “sticky”. This meant that within the downtrend leg of the cycle, it might be difficult to be worthwhile.

When the Housing Begins downtrend, I’d count on DOOR income to comply with go well with. Projecting its efficiency primarily based on the previous few years’ outcomes will result in deceptive valuation. A extra applicable strategy is to primarily based it on the normalized efficiency over the cycle.

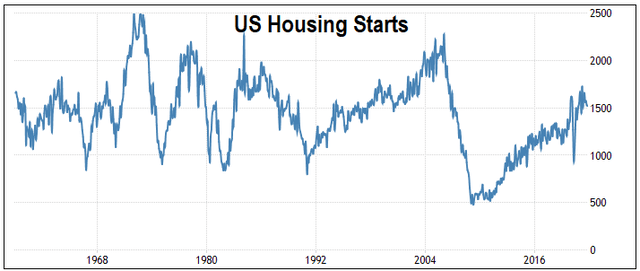

Cyclical firm

The US Housing Begins are cyclical with no long-term progress within the common annual Housing Begins of 1.5 million items. The most recent peak-to-peak is from 2006 to 2022. Check with Chart 1. The Housing Begins over the previous few months have been declining. These are indicators that the Housing Begins are getting into the downtrend leg of the cycle.

Even for those who dispute that the Housing Begins goes into the downtrend, you shouldn’t neglect that there isn’t a long-term progress within the annual common Housing Begins. Projecting DOOR efficiency primarily based on the 1.5 million items of Housing Begins would provide you with an image of its efficiency over the cycle.

Whereas there isn’t a progress in quantity, there may be long-term value progress of 4% each year.

Chart 1: US Housing Begins (Buying and selling Economics.com)

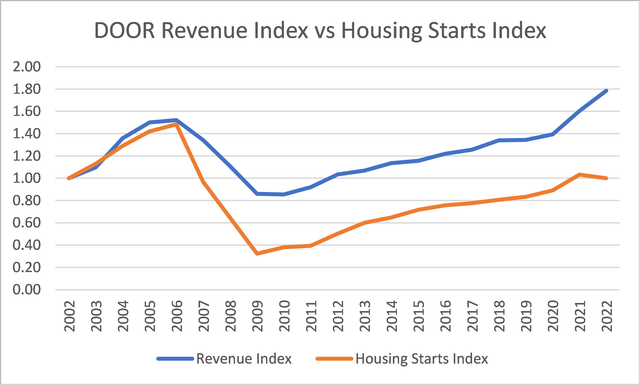

Chart 2 in contrast DOOR income over the previous 20 years with the Housing Begins. You possibly can see that DOOR income tracks the Housing Begins with a 0.73 correlation.

This meant that the US Housing Begins can clarify half of the adjustments in DOOR income. I thought of this a surprisingly important correlation. That is partly as a result of Europe accounted for 10 % of its FYE Jan 2023 income. The non-residential market additionally accounted for 10 % of its whole income.

Whereas there was double digits income progress over the previous 2 years, that is as a result of tailwinds from the uptrend leg of the cycle. When the US Housing Begins enter the downtrend leg, I’d count on DOOR North American income to comply with go well with. As it is a giant a part of the whole income, I’d count on DOOR’s whole income to say no as nicely.

Extra importantly, DOOR is a cyclical firm. Its long-term efficiency and valuation must be primarily based on this cyclical perspective.

Chart 2: Income Index vs Housing Begins Index (Creator)

Notice to Chart 2:

a) Every index was derived by dividing the values for annually by the respective 2002 values (base of 1.00)

b) Because of the adjustments within the FYE, the years confer with the calendar yr. Thus 2022 was primarily based on the FYE Jan 2023 outcomes.

Valuation of cyclical corporations

Damodaran has this to say about valuing cyclical corporations:

“Cyclical and commodity corporations share a typical characteristic, insofar as their worth is usually extra depending on the motion of a macro variable… than it’s on agency particular traits…the most important drawback we face in valuing…is that the earnings and money flows reported in the newest yr are a perform of the place we’re within the cycle, and extrapolating these numbers into the longer term can lead to critical misvaluation.”

To beat the cyclical concern, we’ve to normalize the efficiency over the cycle. Damodaran urged 2 methods to do that:

Take the common values over the cycle. Take the present income and decide the earnings by multiplying it with the normalized margins.

The problem with the primary strategy for DOOR is that the dimensions of the corporate presently is much higher than that in 2006. I thus adopted the second strategy when taking a look at its worth over the cycle.

Cyclical efficiency

I’ve talked about that DOOR income tracks the Housing Begins with the downtrend from 2006 to 2009 adopted by the uptrend.

Nevertheless, the earnings had been very a lot affected by uncommon gadgets corresponding to impairments and restructuring costs. From 2006 to 2022:

DOOR Earnings earlier than Tax (EBT) was a complete lack of USD 677 million. If the weird gadgets had been excluded, we’ve a complete optimistic EBT of USD 911 million. DOOR throughout this era expensed USD 1.59 billion for uncommon gadgets. About ¾ of the bills had been incurred in the course of the downtrend interval of 2006 to 2009.

To trace the earnings over the cycle, it makes extra sense to have a look at EBT earlier than uncommon gadgets. I’d then deal with the weird gadgets corresponding to impairments individually.

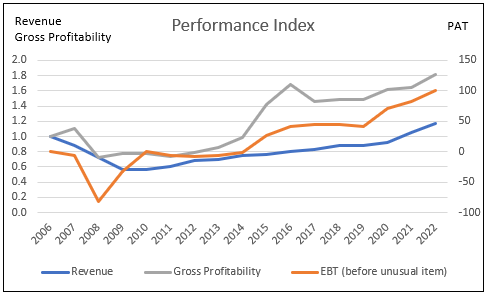

I checked out 3 metrics to trace DOOR efficiency during the last cycle – income, EBT earlier than uncommon gadgets, and Gross Profitability. To plot these 3 metrics on the identical chart, I transformed them into indices. Check with Chart 3.

You possibly can see EBT earlier than uncommon gadgets and Gross Profitability present very related patterns as that for the income.

Chart 3: Efficiency Index (Creator)

Notes to Chart 3:

a) Every index was derived by dividing the values for annually by the respective 2006 values (base of 1.00)

b) Because of the adjustments within the FYE, the years confer with the calendar yr. Thus 2022 was primarily based on the FYE Jan 2023 outcomes

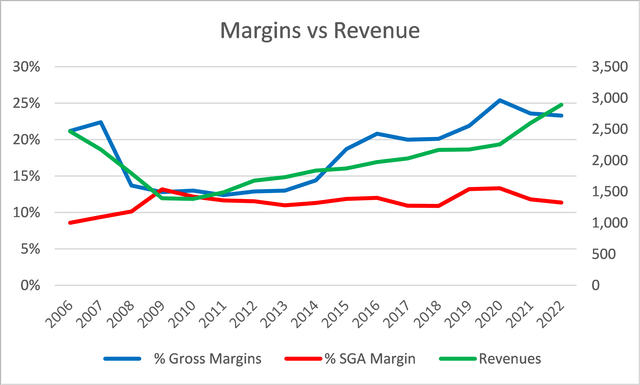

To get a greater image of the traits, I tracked the Gross Revenue margins and Promoting, Normal and Administration (SGA) margins towards income as proven in Chart 4.

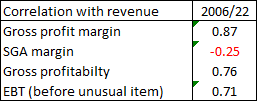

Gross Revenue margins have improved in the course of the uptrend. There’s a 0.87 correlation between the Gross Revenue margins and income from 2006 to 2022. SGA margins deteriorated. The SGA margin in 2022 was larger than that in 2006. The comparatively “sticky” margin from 2010 to 2022 meant that DOOR incurred proportionately extra SGA bills to promote extra. If the Firm had been extra productive, the SGA margins could be decreased with larger income.

Chart 4: Margins vs Income (Creator)

For these statistically inclined, I’ve tabulated in Desk 1 the correlation between income and the varied metrics.

The excessive correlation for the Gross Revenue margin signifies that when income declines, so will the Gross Revenue margin. Not precisely a very good signal for a cyclical firm.

You possibly can see that the correlation for the SGA margin of -0.25 isn’t important. It signifies that the SGA margins don’t fluctuate with income. That is dangerous information for DOOR as a result of when income declines, the Firm will face comparatively excessive SGA bills.

Desk 1: Correlation (Creator)

You shouldn’t be stunned by the SGA findings because the Firm is addressing this:

“In December 2022, we started implementing a plan to enhance total enterprise efficiency that features the optimization of our manufacturing capability and discount of our overhead and promoting, basic and administration workforce…”

Monetary efficiency

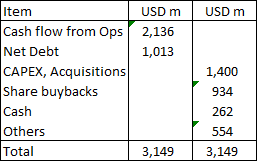

Traditionally, within the downtrend a part of the cycle, not solely did income decline however there have been additionally impairments. You’d need DOOR to be financially sound going into the downtrend of the approaching cycle in order that it could face up to these 2 impacts.

My key concern about DOOR is that it presently had a Debt Fairness ratio of 1.44. I usually keep away from corporations with a Debt Fairness ratio of greater than 1.0.

Nevertheless, that is partly offset by the next:

It has a mean curiosity protection ratio (EBIT/curiosity) of seven over the previous 2 years. Primarily based on Damodaran’s artificial score strategy, its Debt could be rated A (Fitch). It presently has USD 297 million in money. That is about 13 % of the whole belongings. Over the cycle it generated about USD 2.1 billion of Money movement from Operations. This was adequate to fund its CAPEX and acquisitions. There was further to fund among the share buyback. Check with Desk 2. In fact, it additionally elevated its Debt. However wanting on the total image, I’d take into account this a very good capital allocation plan. Whereas there was a rise in Debt, the funds had been used partly for share buyback in addition to to extend money and different investments.

Desk 2: Sources and Makes use of of Funds – 2006 to 2022 (Creator)

Notes to Desk 2:

a) Nearly all of the Others had been for different financing and investing.

b) The CAPEX and acquisitions had been nets of gross sales of PPE and divestments

Valuation

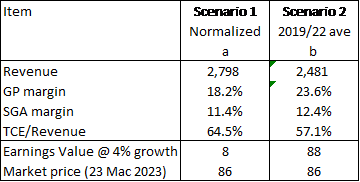

I checked out 2 Situations:

State of affairs 1 – Normalized one over the cycle. I assumed that the normalized income is when the Housing Begins = 1.5 million items. The opposite parameters had been primarily based on the common values from 2006 to 2022. State of affairs 2 – Contrarian one the place the long-term efficiency equals the common efficiency of 2019 to 2022. There have been main acquisitions in 2018 and I assumed that this had modified the enterprise fundamentals.

I valued DOOR utilizing the single-stage Free Money Circulation to the Agency (FCFF) mannequin the place:

FCFF = EBIT(1-t)(1-Re).

EBIT = Income X (GP margin – SGA margin).

t = tax fee.

Re = Reinvestment fee as decided from the elemental equation of progress the place progress= Return X Reinvestment fee.

Return = EBIT(1-t)/TCE

TCE = Whole Capital Employed = Fairness + Debt – Money

In each Situations, I assumed that the long-term progress fee = 4 % primarily based on the long-term GDP progress fee.

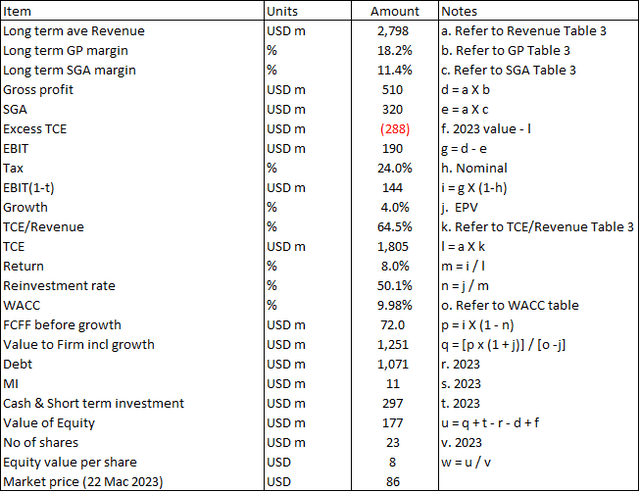

The important thing enter metrics and values are summarized in Desk 3 whereas the small print of the valuation methodology are proven in Desk 4.

The worth of DOOR is:

USD 8 below State of affairs 1. USD 88 below State of affairs 2.

There isn’t any margin of security below each Situations. I’d take into account State of affairs 2 as extremely unlikely because it assumed that DOOR isn’t a cyclical firm. I’m extra inclined to comply with State of affairs 1.

Desk 3: Worth of DOOR (Creator)

Notes to Desk 3:

a) Income primarily based on 2022 adjusted for long-term Housing Begins. I assumed long-term Housing Begins to be 1.5 m items and 2022 Housing Begins to be 1.55 m items. The margins and capital effectivity had been primarily based on the 2006 to 2022 common.

b) Primarily based on the 2019 to 2022 common.

Desk 4: Computation of DOOR worth (Creator)

Notes to Desk 4:

f) The cyclical TCE is larger than the present one. As such, I assumed that there could be further capital required that needs to be deducted from the computed worth of the agency.

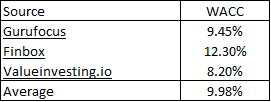

o) The WACC was derived primarily based on a Google search of the time period “DOOR WACC” as proven in Desk 5.

Desk 5: WACC (Numerous sources)

Limitations and dangers

You need to take into account the next when taking a look at my valuation:

Impairments. Cyclical WACC. Residential markets. Enhancements

Going into the cycle, I’d count on some impairments. I’ve not accounted for this in each Situations. In my valuation mannequin, I derived the earnings from Gross Revenue minus SGA. Thus, any impairments must be accounted for individually. This meant the DOOR is extra over-priced than what was computed.

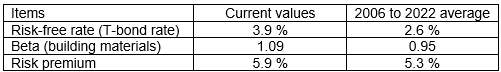

The WACC was primarily based on the present scenario of excessive risk-free charges and excessive danger premiums. Since I’m wanting on the efficiency over the cycle, the varied parameters within the WACC also needs to be primarily based on the values over the cycle.

Desk 6 offers you a way of the variations (primarily based on Damodaran datasets). The cyclical WACC can be decrease than the present ones. As such the values offered are conservative estimates.

Desk 6: Evaluating the WACC parameters (Creator)

Not all of the income got here from the residential markets. There may be the European and non-residential markets which can not by cyclical. A extra correct image could be to worth these non-cyclical segments individually from the cyclical one. Then use the sum-of-parts valuation to find out the whole worth of DOOR. Nevertheless, the worth from State of affairs 1 is a lot decrease than the present market value that there’s nothing to achieve by doing this.

Taking a look at Charts 2 and 4, it’s possible you’ll argue that there have been some enhancements within the operations. The present peak margins are larger than these within the 2006 peak. So, I ought to regulate the cyclical values for the upper peak values. I did attempt to do that however discovered that whereas the Gross Revenue margins had been larger, the SGA margins had been additionally larger (deteriorated). The end result was a decrease EBIT.

The next Gross Revenue margin and a decrease SGA margin will definitely improve the worth. I do know that the Firm is addressing the SGA however till there are numbers to point out the enhancements, I’d not try such a projection.

Lastly, my valuation assumed that there isn’t a important change in its enterprise and product profile. Its progress was partly been as a consequence of acquisitions and this might change the longer term enterprise profile. If the non-residential and European segments get greater, its valuation could also be higher represented by State of affairs 2. However presently, there isn’t a proof of this.

Conclusion

DOOR serves the constructing supplies sector. This can be a cyclical sector and also you shouldn’t be stunned that its income is cyclical. The problem is figuring out the macro parameter to hyperlink DOOR cyclical efficiency.

I’ve chosen to make use of the US Housing Begins because the macro variable – there’s a sturdy correlation between DOOR income and Housing Begins. There may be additionally a robust correlation between the income and Gross Revenue margin.

On the similar time, I’ve the next issues about DOOR as a cyclical firm:

Its SGA margins are extra “sticky” and it could not cut back proportionately with income. Coupled with the sturdy correlation between income and Gross Revenue margins, DOOR can have issues with profitability within the downtrend leg of the cycle. Traditionally there have been impairments of goodwill in the course of the downtrend leg of the cycle. Given that there have been acquisitions in the course of the previous decade, there’s a danger of impairments sooner or later. It has a 1.44 Debt Fairness ratio. On the optimistic aspect, its excessive Debt Fairness ratio is offset by its sturdy artificial Debt score, good money place and capital allocation plan.

The above evaluation reveals that there are points with DOOR’s fundamentals when taking a look at its efficiency over the cycle. Whereas its efficiency over the previous two years was good, they don’t seem to be a very good indication of the long-term cyclical future.

On the similar time, my valuation of DOOR by way of a cyclical lens reveals that there isn’t a margin of security. I’d not spend money on DOOR inventory primarily based on these 2 causes.

You could disagree with my view that the Housing Begins has entered the downtrend leg. This isn’t crucial as 70 years of Housing Begins historical past have proven that there isn’t a long-term progress within the common annual Housing Begins. My valuation was pegged to this long-term annual common. So it doesn’t matter when the downtrend begins you probably have a long-term perspective of DOOR. The hot button is that DOOR is a cyclical firm.

Even for those who ignore the cyclical proof and worth DOOR as a non-cyclical one, State of affairs 2 reveals that there isn’t a margin of security. There may be further motive why I’d not spend money on DOOR on the present value.